Accelerate Growth with Future-Ready Digital Solutions

Smarter AI Digital Services for the Fintech

Fintech companies move fast, and so do we. Our AI tools help with fraud detection, customer service, and product development. With smart automation and real-time insights, we help you scale and innovate with confidence.

Driving Digital Innovation in Fintech

Helping Fintech Adapt, Compete & Thrive in the Digital Era

We build smarter, scalable solutions for future-ready industry transformation.

In launch & optimization phase

Your website is live, but that’s only the beginning. After the launch, we initiate post-launch protocols, involving testing, optimization and an impactful digital marketing strategy.

During this phase, we will:

- Set up rigorous monitoring controls to ensure everything is on track

- Create a tailored maintenance and optimization plan to keep your site running seamlessly

- Develop and put into action an effective digital marketing strategy

Why Choose Us

Fintech Without AI vs. With AI

Stay updated with the latest trends, tips, and insights in business analytics. Explore our curated articles designed to empower your data-driven journey.

How AI Is Reshaping Fintech with Smarter, Faster Innovation

The use of artificial intelligence in finance is transforming the industry. According to McKinsey, AI could deliver up to $1 trillion annually in added value for global banking. By leveraging fintech machine learning, firms can automate fraud detection, personalize services, and streamline compliance. Partnering with an expert AI agency ensures implementation of tailored fintech AI solutions that drive efficiency and revenue growth.

AI weekly Stats

10% ▲

10% ▲

10% ▲

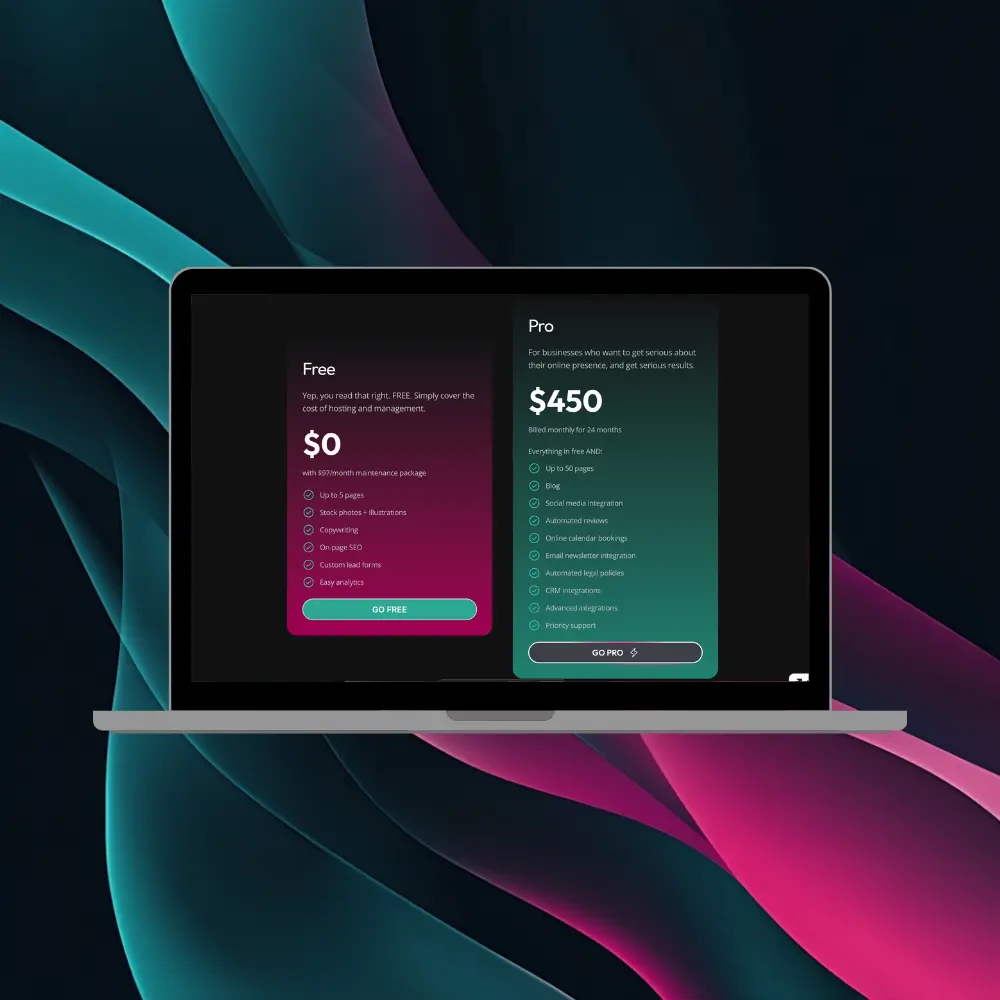

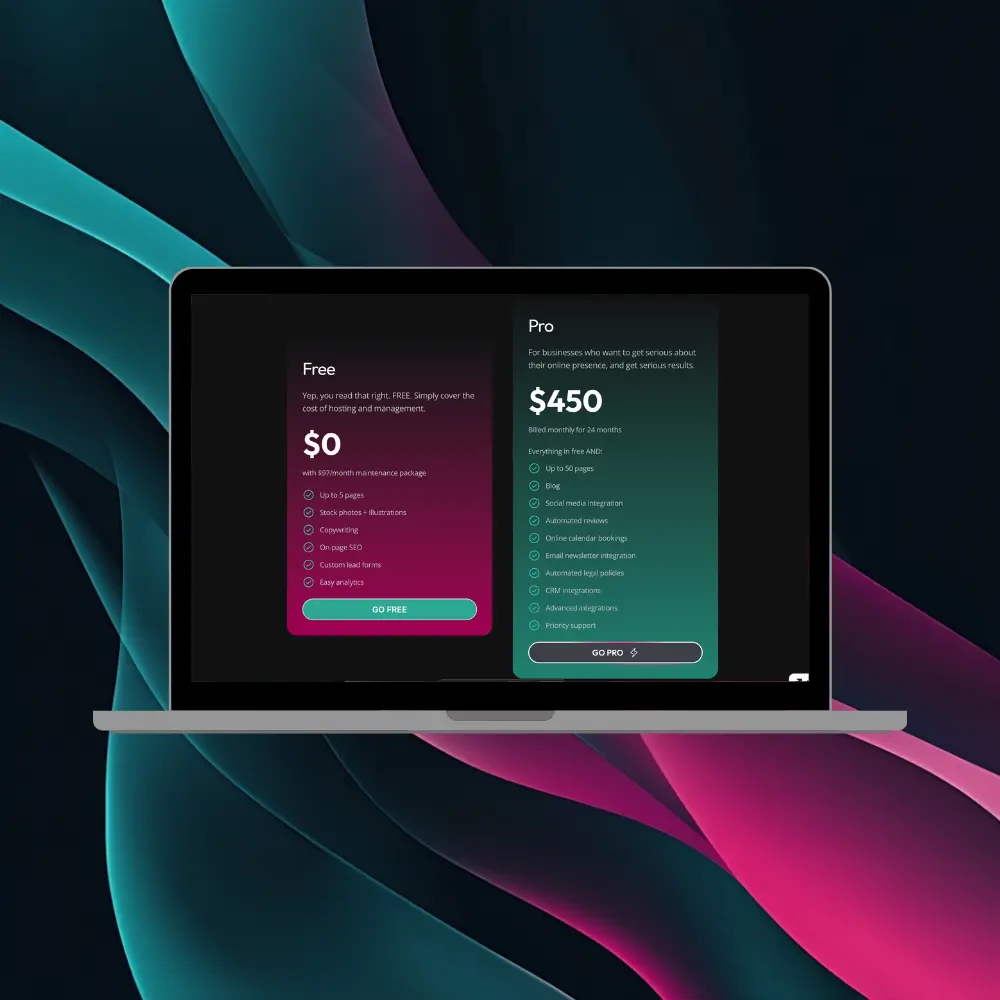

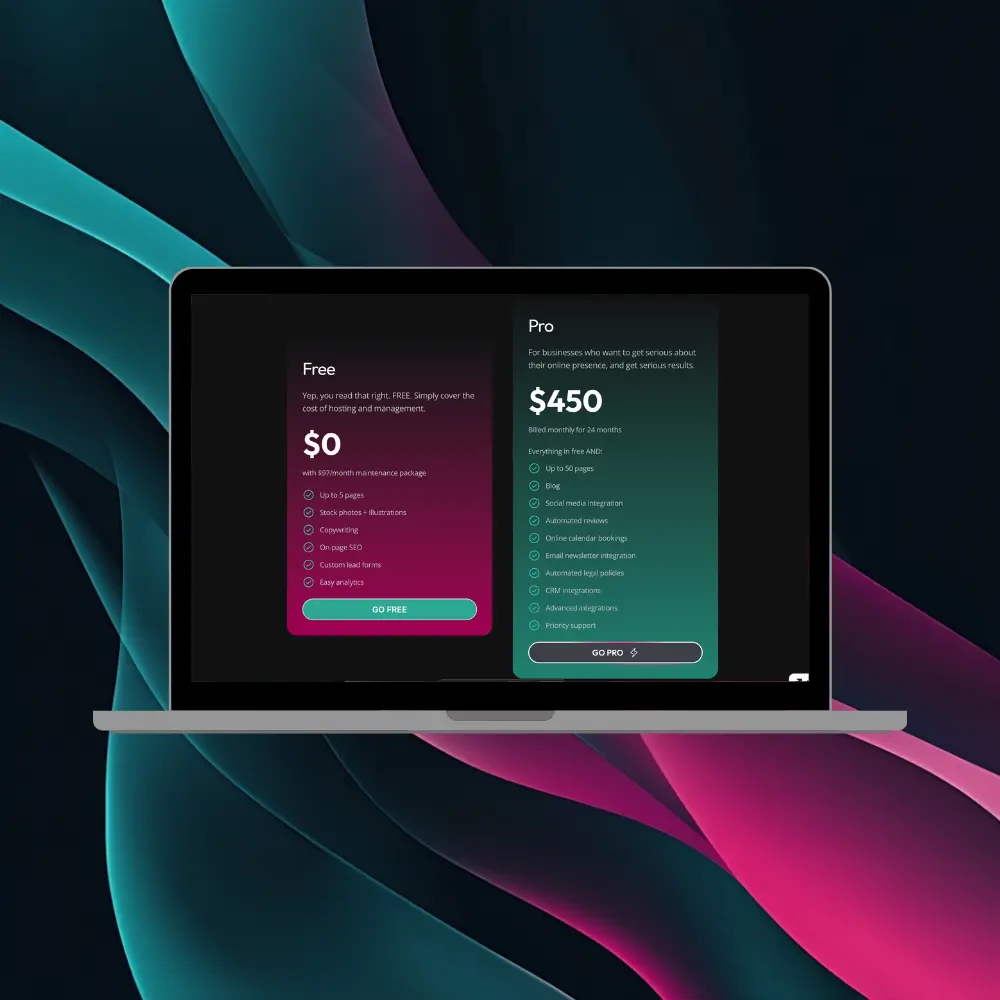

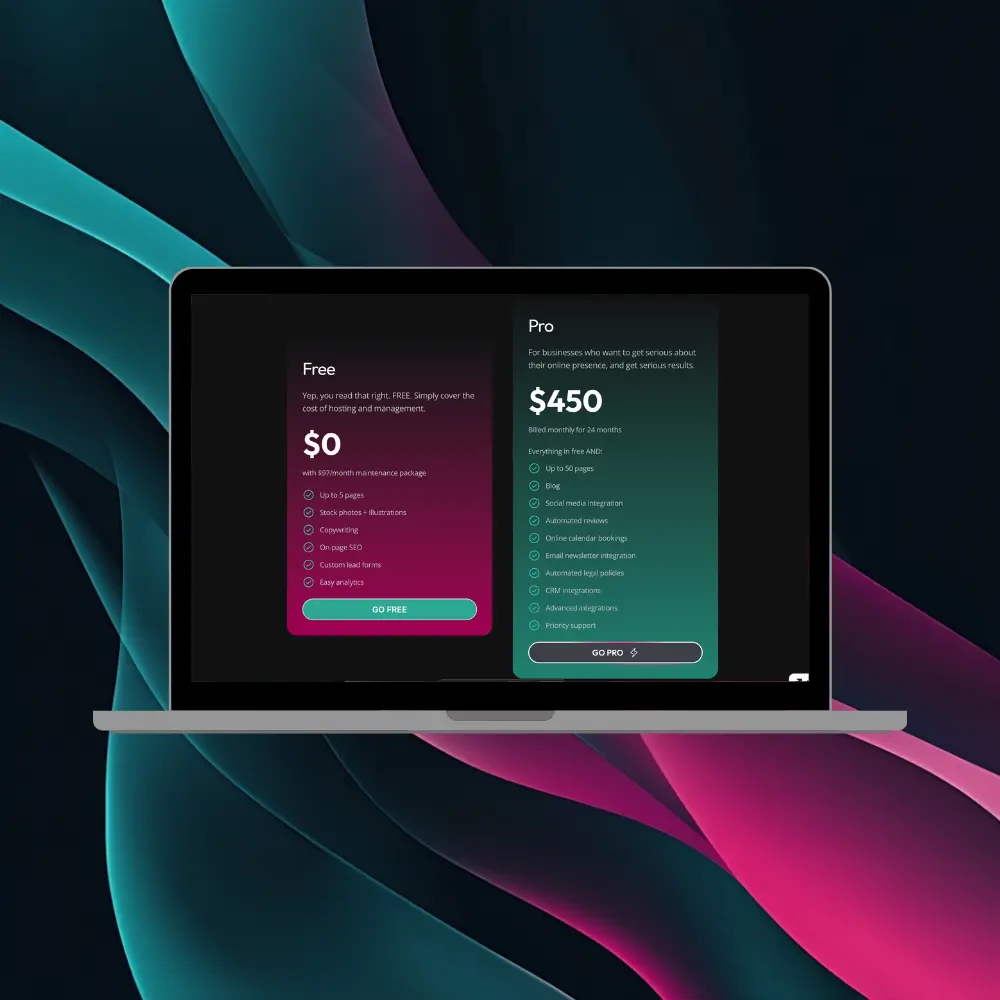

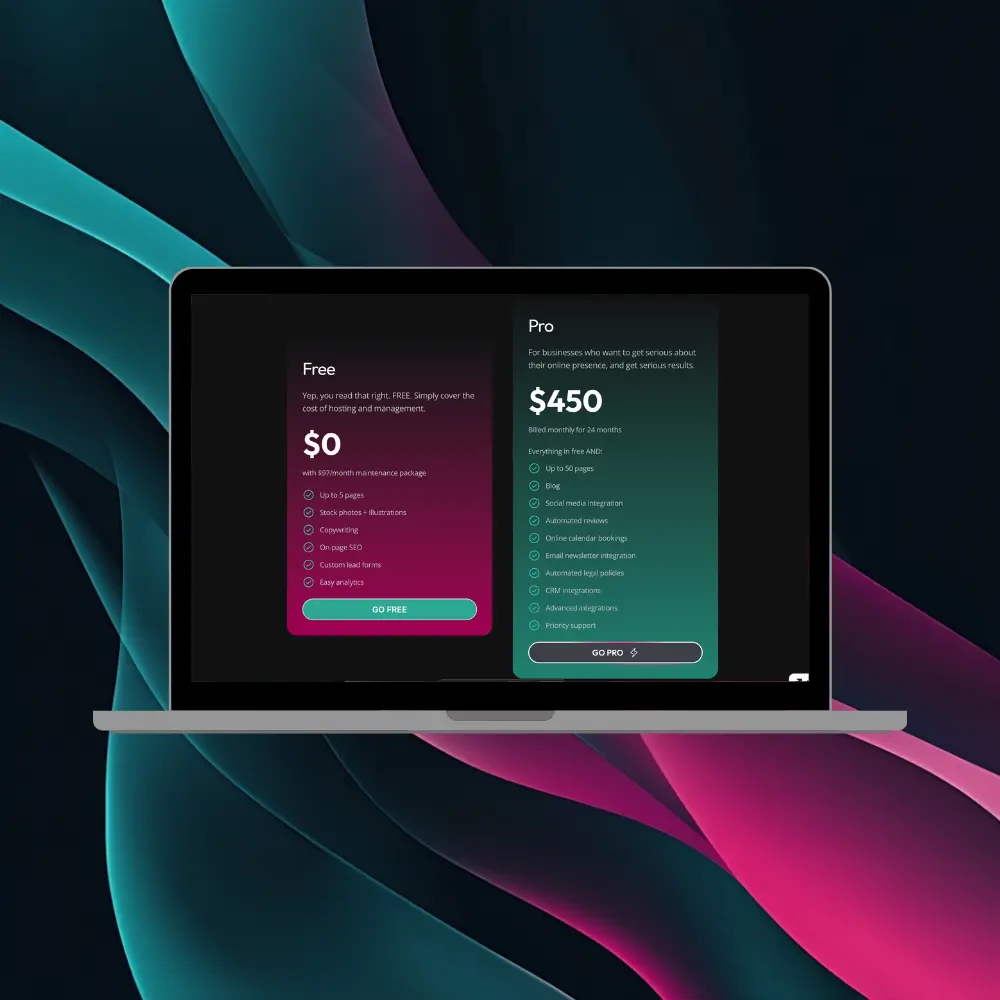

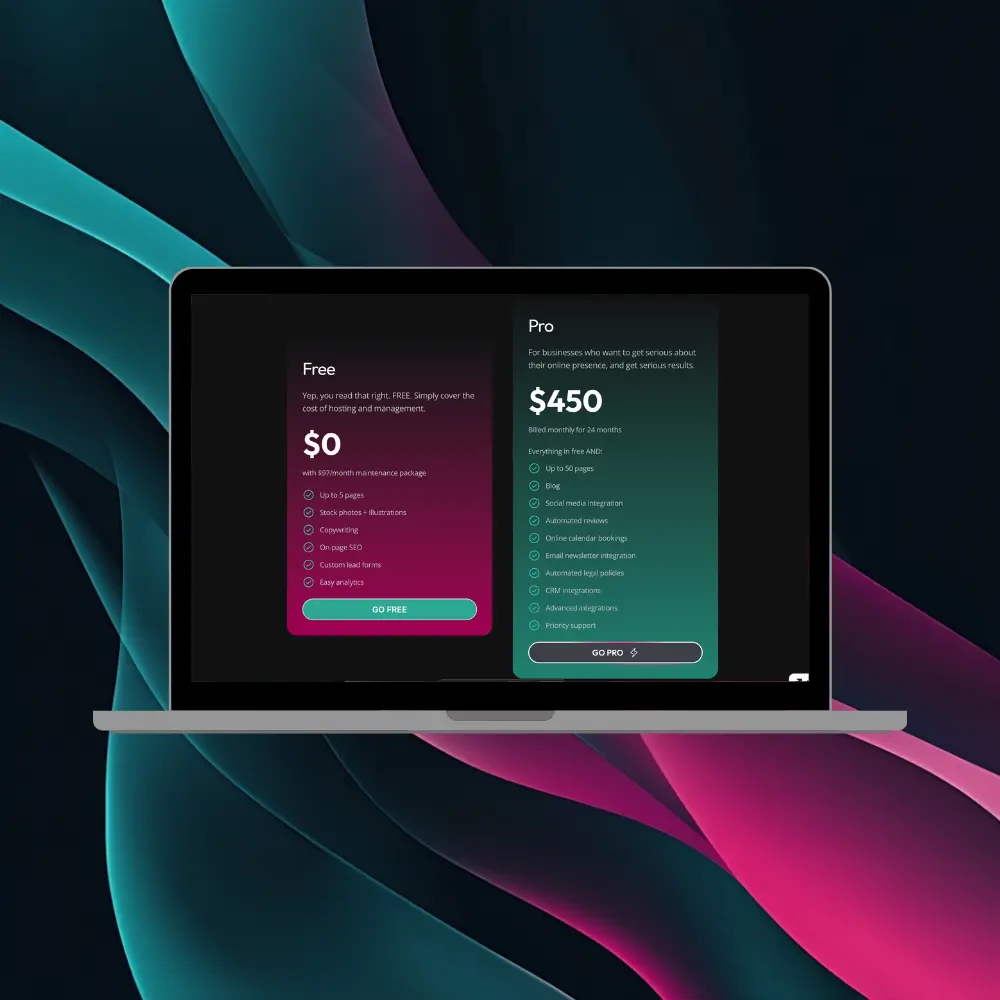

SaaS & Tech

|

FREE |

PAID |

WITH AI | |

|

FREE | |||

|

FREE | |||

|

FREE | |||

|

FREE |

The Reality of Fintech Without AI: Missed Opportunities and Slower Growth

Without AI-powered fintech platforms, companies face slower decision-making, higher operational costs, and increased risk of errors. Traditional models lack the adaptability that fintech innovation offers. A 2023 PwC study found that 52% of financial firms not using AI fell behind in digital transformation. Ignoring artificial intelligence in finance means missing out on automation, predictive analytics, and scalable growth models fueled by fintech machine learning.

At Our Agency, we commit to guiding your Fintech project from concept to completion, embracing each phase as if it were our own. This includes developing customized strategies, providing expert recommendations, conducting comprehensive research and overseeing quality assurance processes.

We also prioritize transparency and continuous communication, fostering a collaborative partnership to nurture and enhance your Fintech online presence and delivering a Fintech web design that perfectly aligns with your needs.

At Our Agency, we steer the course of your Fintech web design journey, meticulously developing strategies and expert recommendations based on thorough research and quality assurance.

Our collaborative approach ensures that you play an active role in shaping your digital presence. We prioritize transparency and foster constant communication to empower you in growing your Fintech online brand and achieving measurable results.

1

Assessing the Fintech Landscape and Competitor Analysis

We start by evaluating your fintech market environment. This sets the foundation for integrating fintech AI solutions aligned with current trends and your business objectives.

In this phase, we:

-

Analyze competitor strategies in fintech innovation and tech adoption

-

Identify untapped gaps and opportunities in financial services

-

Benchmark your business against industry leaders using AI data insights

2

Mapping Data and AI Opportunities

We structure and evaluate your business data to discover where artificial intelligence in finance can create the most impact, driving automation and efficiency.

In this phase, we:

-

Audit internal and customer-facing data across all departments

-

Pinpoint areas for fintech machine learning application

-

Design an AI strategy based on real-time business needs

3

Building Custom AI Models for Financial Use Cases

We create models tailored to your workflows, focusing on tasks where AI-powered fintech platforms can offer predictive, personalized, or real-time outcomes.

In this phase, we:

-

Develop machine learning models trained on industry-specific data

-

Incorporate financial forecasting, fraud detection, and risk analysis

-

Ensure high accuracy and flexibility for changing fintech needs

4

Integration with Existing Fintech Systems

Seamless integration ensures your new fintech AI solutions work with existing infrastructure, boosting speed and minimizing disruption across all systems.

In this phase, we:

-

Align AI models with your CRM, banking, or payment systems

-

Test API connections and real-time data flow

-

Maintain platform stability and cross-system compatibility

5

Optimization and Continuous Learning

Once deployed, we fine-tune and optimize performance to help your AI-powered fintech platforms continuously evolve and adapt to customer behavior and market changes.

In this phase, we:

-

Conduct A/B testing across core features and channels

-

Use feedback loops to retrain fintech machine learning models

-

Optimize for speed, accuracy, and cost-effectiveness

6

Scaling AI Across Operations for Long-Term Growth

After success in key areas, we help scale your AI capabilities across teams to fully embrace fintech innovation and realize 10X faster results.

In this phase, we:

-

Expand AI applications to customer service, compliance, and underwriting

-

Monitor and report on long-term ROI from automation

-

Build a roadmap for sustainable growth using AI-powered fintech platforms